Warranty Expense Contra Revenue . Units sold, the percentage that will be replaced within the. to record the warranty expense, we need to know three things: The nature of a warranty can vary. the tax treatment of warranties can be as complex as their accounting, with implications for both revenue recognition. reporting entities often provide customers with a warranty in connection with the sale of a good or service. financial professionals must track the timing of warranty expense recognition and the actual cash outlays for. what is warranty expense? if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. Warranty expense is the cost that a business expects to or has already incurred for the. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the.

from www.chegg.com

what is warranty expense? reporting entities often provide customers with a warranty in connection with the sale of a good or service. Units sold, the percentage that will be replaced within the. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. to record the warranty expense, we need to know three things: a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. Warranty expense is the cost that a business expects to or has already incurred for the. The nature of a warranty can vary. the tax treatment of warranties can be as complex as their accounting, with implications for both revenue recognition. financial professionals must track the timing of warranty expense recognition and the actual cash outlays for.

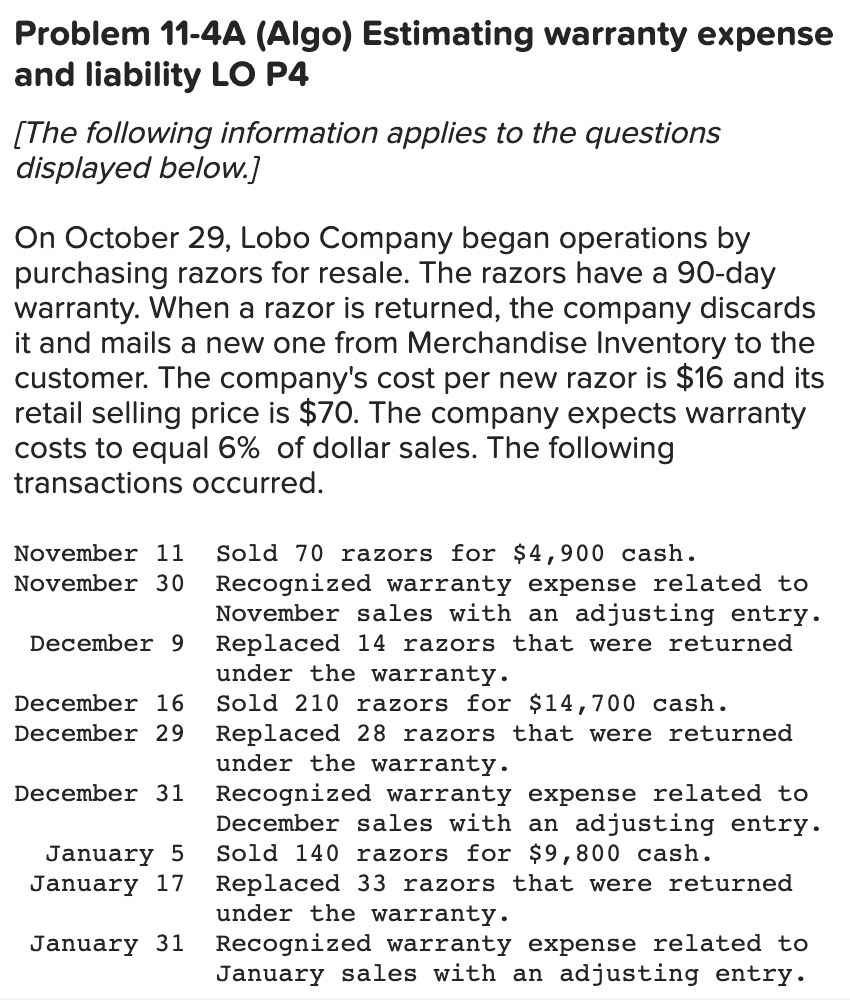

Solved Problem 114A (Algo) Estimating warranty expense and

Warranty Expense Contra Revenue reporting entities often provide customers with a warranty in connection with the sale of a good or service. Units sold, the percentage that will be replaced within the. the tax treatment of warranties can be as complex as their accounting, with implications for both revenue recognition. reporting entities often provide customers with a warranty in connection with the sale of a good or service. what is warranty expense? The nature of a warranty can vary. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. to record the warranty expense, we need to know three things: financial professionals must track the timing of warranty expense recognition and the actual cash outlays for. Warranty expense is the cost that a business expects to or has already incurred for the. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should.

From www.chegg.com

Solved 0 Requirements 1. Record the sales, warranty expense, Warranty Expense Contra Revenue Units sold, the percentage that will be replaced within the. to record the warranty expense, we need to know three things: what is warranty expense? Warranty expense is the cost that a business expects to or has already incurred for the. The nature of a warranty can vary. financial professionals must track the timing of warranty expense. Warranty Expense Contra Revenue.

From www.chegg.com

Solved Problem 114A (Algo) Estimating warranty expense and Warranty Expense Contra Revenue if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. financial professionals must track the timing of warranty expense recognition and the actual cash outlays for. to record the warranty expense, we need to know three things: reporting entities often provide customers with a warranty in. Warranty Expense Contra Revenue.

From www.youtube.com

Warranty Expense & Warranty Liability (Journal Entries) YouTube Warranty Expense Contra Revenue reporting entities often provide customers with a warranty in connection with the sale of a good or service. the tax treatment of warranties can be as complex as their accounting, with implications for both revenue recognition. to record the warranty expense, we need to know three things: what is warranty expense? financial professionals must track. Warranty Expense Contra Revenue.

From www.patriotsoftware.com

Types of Accounts in Accounting Assets, Expenses, Liabilities, & More Warranty Expense Contra Revenue to record the warranty expense, we need to know three things: Warranty expense is the cost that a business expects to or has already incurred for the. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. the tax treatment of warranties can be as complex as. Warranty Expense Contra Revenue.

From www.slideshare.net

Expense Warranty Approach Accounting Warranty Expense Contra Revenue Warranty expense is the cost that a business expects to or has already incurred for the. Units sold, the percentage that will be replaced within the. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. reporting entities often provide customers with a warranty in connection. Warranty Expense Contra Revenue.

From www.chegg.com

Solved 1. Record the sales, warranty expense, and warranty Warranty Expense Contra Revenue a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. Warranty expense is the cost that a business expects to or has already incurred for the.. Warranty Expense Contra Revenue.

From www.slideserve.com

PPT Current Liabilities and Payroll PowerPoint Presentation, free Warranty Expense Contra Revenue what is warranty expense? The nature of a warranty can vary. financial professionals must track the timing of warranty expense recognition and the actual cash outlays for. Warranty expense is the cost that a business expects to or has already incurred for the. the tax treatment of warranties can be as complex as their accounting, with implications. Warranty Expense Contra Revenue.

From cexipzvl.blob.core.windows.net

How To Calculate Warranty Expense In Accounting at John Shay blog Warranty Expense Contra Revenue reporting entities often provide customers with a warranty in connection with the sale of a good or service. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. what is warranty expense? if a seller can reasonably estimate the amount of warranty claims likely. Warranty Expense Contra Revenue.

From involvementwedding3.pythonanywhere.com

Amazing Contra Revenue Account Examples Inditex Financial Statements Warranty Expense Contra Revenue Units sold, the percentage that will be replaced within the. Warranty expense is the cost that a business expects to or has already incurred for the. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. reporting entities often provide customers with a warranty in connection. Warranty Expense Contra Revenue.

From www.chegg.com

Solved Reformulating Financial Statements For Warranty Warranty Expense Contra Revenue Units sold, the percentage that will be replaced within the. reporting entities often provide customers with a warranty in connection with the sale of a good or service. The nature of a warranty can vary. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. . Warranty Expense Contra Revenue.

From www.solutioninn.com

[Solved] The accounting records of Water's Applian SolutionInn Warranty Expense Contra Revenue financial professionals must track the timing of warranty expense recognition and the actual cash outlays for. Units sold, the percentage that will be replaced within the. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when it records the. Warranty expense is the cost that a business expects to. Warranty Expense Contra Revenue.

From zuoti.pro

Reformulating Financial Statements For Warranty Expense Warranty Expense Contra Revenue if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. reporting entities often provide customers with a warranty in connection with the sale of a good or service. a warranty is a contingent liability, so the party providing it should record a liability and warranty expense when. Warranty Expense Contra Revenue.

From www.youtube.com

What is contra account Contra Account definition and Examples YouTube Warranty Expense Contra Revenue Warranty expense is the cost that a business expects to or has already incurred for the. reporting entities often provide customers with a warranty in connection with the sale of a good or service. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. The nature of a. Warranty Expense Contra Revenue.

From www.educba.com

Warranty Expense Warranty Expense Tax Treatment Warranty Expense Contra Revenue what is warranty expense? financial professionals must track the timing of warranty expense recognition and the actual cash outlays for. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. Units sold, the percentage that will be replaced within the. Warranty expense is the cost that a. Warranty Expense Contra Revenue.

From quiznutritions.z13.web.core.windows.net

How To Calculate Warranty Expense Warranty Expense Contra Revenue what is warranty expense? financial professionals must track the timing of warranty expense recognition and the actual cash outlays for. the tax treatment of warranties can be as complex as their accounting, with implications for both revenue recognition. The nature of a warranty can vary. to record the warranty expense, we need to know three things:. Warranty Expense Contra Revenue.

From www.carunway.com

Warranty Expense Journal Entry CArunway Warranty Expense Contra Revenue what is warranty expense? if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. Warranty expense is the cost that a business expects to or has already incurred for the. to record the warranty expense, we need to know three things: financial professionals must track the. Warranty Expense Contra Revenue.

From smallbizclub.com

5 Ways to Decrease Your Business's Warranty Costs Warranty Expense Contra Revenue Warranty expense is the cost that a business expects to or has already incurred for the. the tax treatment of warranties can be as complex as their accounting, with implications for both revenue recognition. Units sold, the percentage that will be replaced within the. The nature of a warranty can vary. reporting entities often provide customers with a. Warranty Expense Contra Revenue.

From www.chegg.com

Solved 1. Record the sales, warranty expense, and warranty Warranty Expense Contra Revenue if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it should. reporting entities often provide customers with a warranty in connection with the sale of a good or service. The nature of a warranty can vary. the tax treatment of warranties can be as complex as their accounting,. Warranty Expense Contra Revenue.